By the end of this week, we’ll be saying farewell to 2022 and welcoming 2023. How I started the year and how I’m ending it couldn’t be more different. It’s not a question of bad versus good, or vice versa. This limiting dichotomy doesn’t work in my experience.

I undertook a psychological transformation mid-year that lit a fire under me, a fire I don’t want extinguished. I began the year with the same mindset as the previous twenty-one years: I’ll work until I retire at the traditional retirement age (I no longer think this). I was okay with this mindset at the time, but I wasn’t okay with having debt, a never-ending reality the past twenty-one years. So I set out to stick with the budget Ana created for me in 2021 and work to become debt-free by year’s end.

I succeeded in sticking to my budget, but I failed to pay off the last credit card balance I’ve had for some time in full. It was a missed opportunity because I wasn’t being charged interest (0% APR balance transfer). At the beginning of the year, I decided to take advantage of CapitalOne’s 0% APR offer for balance transfers so I transferred the balance on my American Express to my existing CapitalOne Card. I was convinced I would be able to pay off the balance in full by the end of this year, but alas, I fucked up and had to apply for another balance transfer offer.

Sidenote: 0% APR balance transfer offers work if you have the right mindset. Yes, you have to have the right mindset to take advantage of this offer. You cannot view the card that was paid off as having available credit to use. Yes, technically, you have available credit on the card you paid off using the balance transfer but if you use the card you paid off while you’re paying off the old balance on the new card, you’ll find yourself doubling the amount you owe. That felt like a tongue twister. You’re going to find yourself in deep trouble. If you want to pay down debt and you have the right mindset, apply for a 0% APR balance transfer. DO NOT use the old card. Either cut it up, or stash it away.

Even though I failed to pay off the last significant debt I had, I succeeded in saving and investing $10,512.23 (not including dividends & interest payouts, which are automatically reinvested in all investment accounts). The majority of this total amount was saved and invested beginning in late August. Imagine what I could’ve accomplished financially if I was steadily employed from the beginning of the year! Woulda, coulda, shoulda!

Let’s break this down between pre-tax saving and investing (401k) and after-tax saving and investing (Roth IRA, taxable brokerage account, REITs, emergency fund, and regular savings). I’m not including my sinking funds because that money is meant to be spent at some point.

Pre-tax Saving and Investing

My company offers a 50% match on an automatic 6% contribution in my 401k. The company will match my contribution in my traditional IRA account not in the Roth option. I contribute 10% of my semi-monthly paycheck ($3,958.50) into the Vanguard Target Retirement 2050 Fund. The expense ratio is low, and it has a good balance of aggressive and conservative investment options. I was going to increase my 401k contribution, almost max it out, but I decided against that idea because I want to pay down the last credit card balance I have by the end of next year; otherwise, I would have contributed $650 each paycheck in order to save $15,600. By the end of 2022, I’ll have saved and invested $3,004.22 (including employer contribution) in my 401k. It’s not a lot, but it’s a start.

Post-tax Saving and Investing

My Roth IRA through Fidelity has a little less than my 401k, and I definitely plan to max it out next year (contribute the maximum amount of $6,500). At the moment, I’ve saved and invested $2,581.98 in my Roth IRA (all dividends are reinvested). I chose FXAIX, Fidelity’s index fund that tracks the S&P 500, for this reason and because it has a low expense ratio (most important factor when investing in index funds).

In keeping with investing in the stock market, I’m investing, primarily, in Vanguard’s VTI (Total Stock Market ETF) through E*Trade. I was investing in a few others, but I’ve decided to invest only in VTI because it’s tracking the entire U.S. equity market and because I want to avoid having to rebalance my portfolio every year. It’s slightly more volatile, but it has outperformed the S&P 500 in the last twenty years, so they say. I’m investing in a taxable brokerage account because I want access to this money without being penalized; you will be penalized for withdrawing money from your retirement accounts before 59 1/2 years of age. And this is an important account to have if you want to reach financial independence before traditional retirement age.

My portfolio of investments also includes Fundrise, a Real Estate Investment Trust (REIT) that allows me to invest in real estate without the headache of being a landlord. I want a piece of the real estate pie, and I think REITs are a great way to get into real estate without too much hassle. Unfortunately, I’m going to have to skip investing in this next year if I’m to rid myself of credit card debt. I’ll pick it up again in 2024.

Let’s move on to saving and not investing. I have three savings accounts with my bank, all three serve a specific purpose.

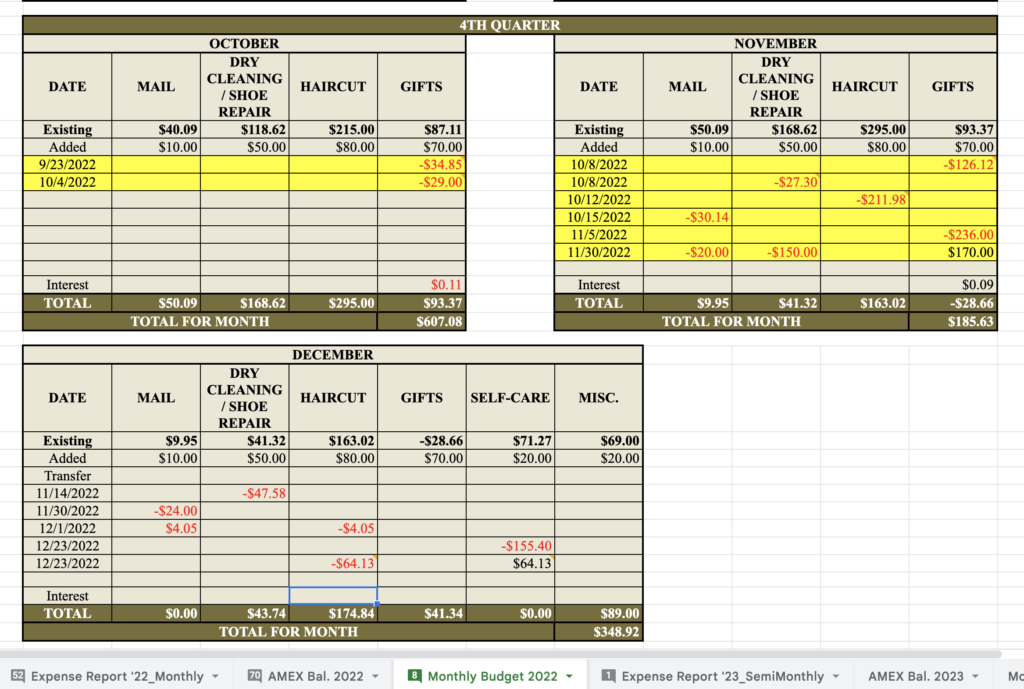

Monthly

My Monthly savings account is my sinking funds account. I save for what I need or want in four different categories, now six categories. When Ana and I first began working together, she asked me what mattered most and helped me create sinking funds for four categories (see photo below). I adopted her cash stuffing method to save for haircuts and gifts and other things. It was a great way to set aside money, but I grew tired of going to the bank to withdraw funds. I decided to go digital and create a Google sheet (I love my Google and Excel sheets!) to track my sinking funds.

Instead of withdrawing money from the bank, I transfer the money from my checking account into my Monthly savings account on the 30th of every month (payday), only transferring back the amount I spent on an item(s) from the designated categories. I have to admit that this takes discipline. You have to have the right mindset to be able to do this because you can’t transfer money from your savings account to your checking account just because you don’t have money to party this weekend.

A lot of personal finance “gurus” recommend having your savings account in a separate bank, which is great if that’s what you need in order for this to work for you, but I truly believe that you can have one bank for all your checking and savings needs if you have the right mindset. You’re going to see me use the word mindset a lot. Don’t complicate your life by having accounts in three different banks because you lack the discipline. Work on your mindset in order to feel comfortable around money.

Emergency Fund

Ana taught me the importance of having an emergency fund for emergencies. My only emergency fund before I began saving for all emergencies was my HSA because I equated (still kind of do) emergencies with medical emergencies. While your emergency fund should be used for that, it’s not only for medical emergencies. If you get laid off from work, you’ll have some money to carry you over while you look for a new job. If you need to replace your car’s windshield because a bird decided to commit suicide (boy, do I have a story for you), you’ll have money to pay for that windshield. In essence, your emergency fund is to be used for unexpected expenses.

Alert! Your emergency fund is not to be used for clothing, shoes, weekend soirees, brunch, paying off debt (guilty!), engagement rings, etc. Again, having the right mindset will enable you to set aside money that can’t be withdrawn until it has to be withdrawn.

Save for Big Stuff

That’s the name of my third savings account. I’m not kidding. This account is used for big stuff, which really only means vacations but includes furniture. Beginning in my early twenties and through my mid-thirties, I would pay for my vacation using my credit card, and then I would make above-the-minimum payments throughout the year while charging more vacations. I don’t want to be that person anymore. I want to be able to save for a vacation and not have to worry about the cost in the end.

Perhaps this all sounds a bit complicated, but I assure you it’s not. I don’t spend more than fifteen minutes every payday paying my bills and transferring money from one account to another. I flat out refuse to automate any of this because I’m a big believer in knowing how to do shit (hasn’t technology incapacitated enough humans?). Also, you’ll be successful in saving and investing if you have the right mindset whether you automate credit card payments, saving and investing, or not. You should be able to view your account balances without getting the itch to move money around to justify going out, buying clothes or shoes, or just living. It’s all in the mind. Work on your mindset to achieve the financial independence you need to give you options in life.

Check In On Your Finances

Now is a good time to check in on your finances. How did you do in 2022? Did you overspend? If so, by how much? Can you cut back on frivolous purchases? Did you save any money? If so, how much? Did you have to dip into your emergency fund (EF)? If so, how much did you take out? And are you working to replenish your EF? Let’s talk if you don’t have an EF. Were you able to pay off/pay down debt? If not, what can you do to get rid of it altogether or decrease the existing balance? You don’t have to answer these questions in the Comments section (you’re more than welcome to).

These are questions you should be asking yourself when you review your finances, and you need to review your finances. How frequently? It’s up to you. I was the victim of fraud, a full account takeover. Every cent was taken from my checking and savings account, so I would err on checking your finances more frequently than not. Because I don’t automate, I force myself to review my checking and savings accounts, and my credit card every two weeks (payday). I don’t look at my investment accounts that frequently. Money is going into those accounts, and it’s definitely not coming out anytime soon. I recommend using Personal Capital to check on your net worth and overall financial health.

Personal finance is personal, so I’ll never tell you what you should do. However, there are fundamental principles in personal finance that will guarantee your success if followed correctly. One of those founding principles is having the right mindset so for 2023, sit down and think about how you view money, and work on developing the right mindset to maximize your chances at achieving financial freedom.

I’ll touch on credit scores in the future, but this is where I’m at with my credit scores. I’m elated to see I’ve finally reached the 800s, and I’ve reached a positive net worth. Here’s to seeing these numbers grow in 2023.

TransUnion = 804 / Equifax = 806 / FICO = 789

Net worth (Personal Capital) = $2,015